Halfway into 2025, we have a clearer perspective on the art market of 2024, which offers valuable insights as we move forward. What stands out is that while high-end blue-chip sales softened, volumes climbed at more accessible tiers. Below, we examine how contemporary and pop art performed across fairs, auctions, galleries, and tech.

Global Market Overview

According to the Art Basel & UBS report, the global art market recorded approximately $57.5 billion in sales in 2024, marking a 12% decline by value, but a 3% rise in transaction volume, signaling buyer resilience at lower price points. Auction sales of works priced over $10 million plunged nearly 45%, while works under $5,000 saw growth, especially in galleries with up to $250k turnover (+17%) and auctions of affordable art (up to $5k).

In the state of the art market today, this bifurcation reflects both macroeconomic caution and democratization – buying volumes rise even as big-ticket values slip.

Fernando Botero, "Woman With Lipstick"

Contemporary & Pop Art at Auction

-

Contemporary art saw approximately $1.888 billion in auction turnover in 2024, across 132,000+ transactions – an all‑time record in volume, anchored by large numbers of lots under $5,000.

-

Ultra‑Contemporary (artists under 40) made up 8% of that market ($150 million), buoyed by increased female representation and rising presence of under‑40 artists.

-

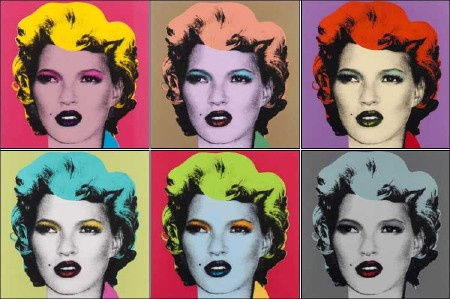

Pop art, especially blue-chip names like Warhol, remained a stabilizing factor. Print sales of iconic Warhol images are noted for their long-term steadiness, weathering broader economic headwinds.

Notably, while high‑end segments cooled (~21% drop over $50k works), demand surged for accessible multiples by artists like Damien Hirst, Takashi Murakami, KAWS and Banksy.

Banksy, "No Ball Games", 2006

Gallery Performance & Fair Buzz

Online marketplace Artsy reported that in 2024, gallery sales per gallery rose 15 % year-over-year, reaching levels unseen since 2021. Collectors are engaging more deeply, with alerts up 48 %, hinting at long-term purchasing interest.

Fairs also played a pivotal role: Affordable Art Fair celebrated its 25th anniversary in 2024, focusing on works under £7,500/€10,000, while blockbuster shows like Frieze in London, New York, Seoul and Los Angeles continued setting cultural and commercial tempo. In Asia, galleries like De Sarthe showcased striking installations at Art Basel Hong Kong, driving attention – and Instagram engagement – toward contemporary practices.

Tech, Platforms & Lock-in Trends

Technology shaped the state of the art market in 2024. Online and hybrid sales thrived: Auction platform volumes climbed around 38.8% in H1 2024, comprising over 42% of online-only auction sales, though average lot price dipped around 6.6% to $20,199. Private auctions also grew by around 14% year-over-year.

Platforms are introducing features that deepen engagement: Artsy’s alerts, combined with improved transparency and AI, are reshaping collector behavior and raising the state of the art market to a data-driven level. Still, traditional galleries and auction houses – especially at the high end – remain cautious.

Implications for Galleries

-

Focus on affordable contemporary – The surge in <$5,000 works highlights demand for accessible art. Limited editions, multiples, and works by emerging contemporary or pop artists may perform especially well.

-

Bridge physical with digital – Hybrid events and online sales remain crucial. Enhanced digital presentation – livestreams, virtual viewings – helps position galleries competitively.

-

Pop art resilience – Blue-chip and print-based pop works provide stability against market headwinds. Balanced exhibitions combining established names with emerging contemporary artists can appeal to both prestige collectors and newer buyers.

-

Fairs remain vital – Participation in fairs like Affordable Art Fair or curated sectoral fairs enhances visibility and broadens reach, particularly outside the gallery’s base.

In summary, the state of the art market in 2024 is defined by value-led volume, technology-fueled engagement, and a renewed role for mid-tier contemporary and pop artworks. While stress at the high end tempers headline figures, galleries offering compelling, accessible artworks and embracing digital integration are well-positioned for growth.

For galleries, this context offers exciting opportunities – to creatively balance exhibitions, digital reach, and market pacing, engaging today’s collectors. The art market of 2025 may reward those who read and adapt to the currents of change. Make sure to also check out our article about Defining Art Trends in 2024, as we continue to observe and engage with the ever-evolving art world.